Self-employed Web Cloud

It’s designed for use at the level of Self-Employed or Communities of Assets

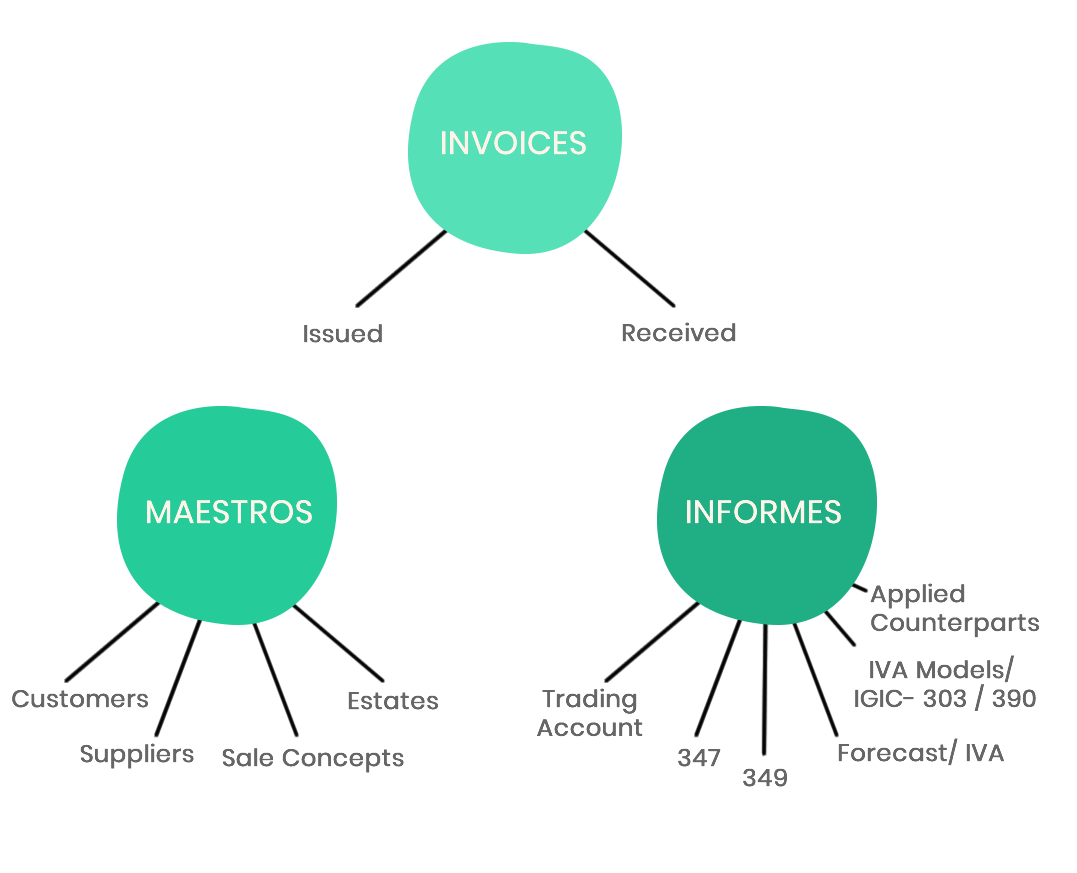

The Diagram Block defines the basic functions. It currently allows working in Spanish, Catalan, French, English and German, and has the following characteristics:

Once the data has been entered, the user knows if he makes or loses money in his Economic or Professional Activity. The expense items are already predefined and practically coincide with those displayed in form 100 of the Tax Agency’s Income Statement, therefore make it easier their preparation.

The result of the VAT is displayed and withholdings, whether for Professionals or Rentals. In this way you can know what is the amount of IVA or IRPF to pay in advance of filing taxes. The preview of the 347 model allows calculations of purchases and sales from a certain amount, in addition to the 3.005 euros of Tax.

The introduction of invoices issued is easy and fast and is prepared for three different types of IVA and Equivalence Surcharge. Allows you to generate Direct Invoices

Generates lists of invoices issued, received, expenses, intra-community, export, as well as the type of Investment of the passive person. Listed according to the counterparts applied together with their percentages.

WhatsApp us